This article originally appeared in our monthly newsletter, Fiscal Therapy.

Please subscribe if you'd like to receive similar articles on a monthly basis.

WHAT I’M THINKING ABOUT: How much is enough?

Is saving important? Absolutely. Can a personal finance guru tell you exactly how much you need to save? Not a chance.

Several articles circulated this month about what defines a sufficient amount of savings. This article said you should have twice your salary saved by age 35 — Twitter disagreed. Another indicated you need to have $25 million before a private bank will consider you “rich.”

I’ve never liked the use of formulas or bright lines as a measure of financial success. The best anyone can offer without knowing the specifics of your situation are guiding principles and habits, such as living below your means and planning for financial emergencies.

It’s all relative

Defining how much savings is enough is all about context. What are your goals and values? Are you paying off debt, supporting a parent, investing in a new business, going back to school? A good starting point for your long-term savings target when you're young is 10% of pre-tax income, but that should scale up or down based on your goals, family and career circumstances, and past savings.

If you’re feeling “behind” on savings, don’t fret. Focus less on past mistakes or circumstances out of your control and more on what percentage of income you’re saving, spending, and giving today. Consider what makes sense for you today given your goals and values.

If you’re one of the few who can pat yourself on the back when it comes to savings, be careful not to get overconfident. Are you continuing to be smart with how you’re adding to your savings? How about debt and spending? Are you living below your means and avoiding high-interest debt? Financial discipline will allow you to direct more of your excess to goals that really matter to you, like saving for a home or giving to worthy causes.

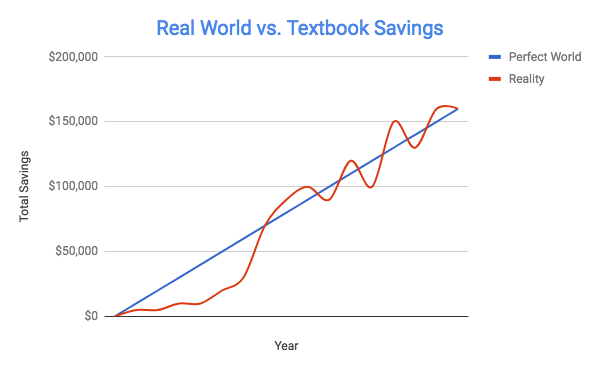

Saving is rarely linear

One reason I don’t like formulas to gauge your savings is they assume a textbook life. In reality, saving is never linear. It ebbs and flows as life happens, which is completely fine and normal (and there’s a wide spectrum of “normal”). As the chart below illustrates, your savings most likely look something like the red line. Especially if you’re working to pay off student loans, you’re going to have a slow start but can hopefully boost savings as you pay off debts.

Fun facts about saving

Persistent actions add up. If you save 7% of your income every year for 10 years, you’ll have about one times your salary saved in 10 years (assuming average investment growth).

No debt or graduate school. Mostly likely, only those who graduate on time with no debt, no dependents, and don’t continue on to graduate school will have the potential to hit the 2x income by 35 rule. Those fortunate individuals are few and far between. To hit this mark, you need to save about 10% of your pre-tax income each year from age 22-35. Even then, 10% might be unrealistic for some graduates. Starting salary and cost of living are big factors.

- Start small then turbo charge. If you can only afford to save a small percent of your salary while you pay off debts, that’s fine. Start where you can and slowly increase this amount as debts are paid off and income increases. Once you’re debt free, you can repurpose those debt payments and turbo charge your savings.

How much money is enough? “Just a little bit more.”

- John D. Rockefeller

WHAT I’M READING

Here are two interesting articles I read this month:

Great Things Take Time

By Nick Maggiulli, Of Dollars & Data

This article ties into what we’ve already been discussing and encourages you to keep the long-view in mind. It’s a marathon, not a sprint, and you must remain wise and clear-headed throughout.

The (Long) List of Financial Documents You Should Keep

By Ron Lieber, The New York Times

Now that April 15 has passed, are there any old tax returns and other documents you can toss? As your wardrobe goes through spring cleaning, here’s a thoughtful list of financial documents that you should save and guidelines for when it’s okay to shred.